Performance (Morningstar Rating *****)

SaraSelect P CHF – Data as of 28.02.2025

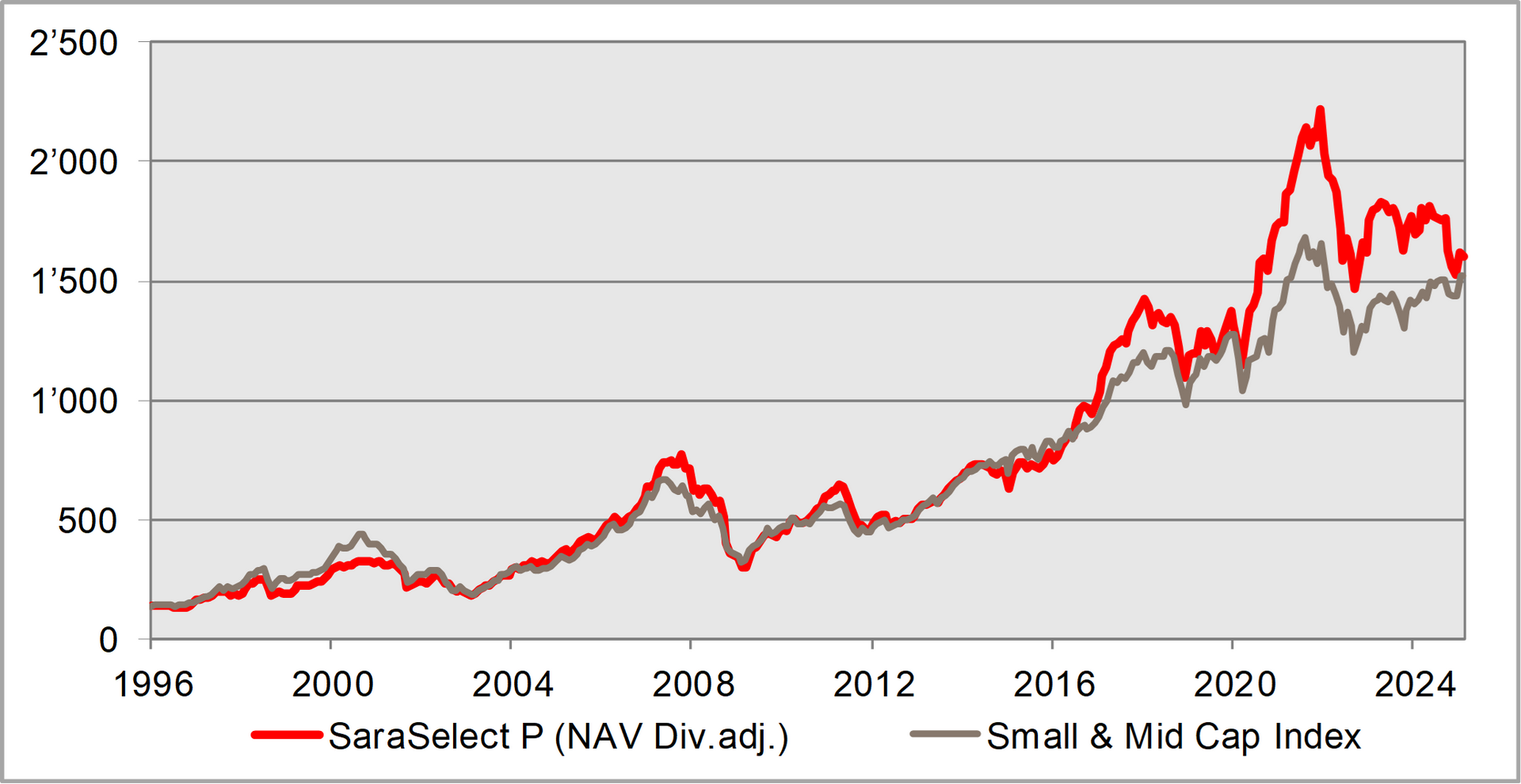

Since inception early 1996 the SaraSelect fund has experienced an annual net performance of 8.89% (after costs!). An initial investment of CHF 100'000 would have multiplied to a amount of CHF 1'189'950.- in 29.08 years, including tax efficient payouts.

Chart since inception on 1 Februar 1996

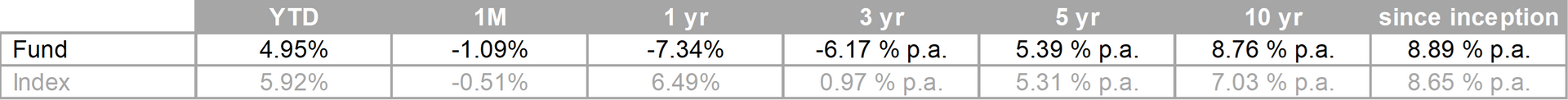

Performance Overview

| YTD | 1 Monat | 1 Jahr | 3 Jahre | 5 Jahre | 10 Jahre | seit Start | |

| Fonds | 10.39% | -1.52% | 12.85% | 8.60% p.a. | 6.08% p.a. | 12.16% p.a. | 9.82% p.a. |

| Index | 9.09% | -0.38% | 9.83% | 6.19% p.a. | 3.58% p.a. | 9.52% p.a. | 8.86% p.a. |

Note

Past performance does not guarantee future returns. The performance shown does not take account of any commissions and costs charged when subscribing and redeeming units.

VV Reports

2024

2021

2018

2015

VV Vermögensverwaltung AG • Chamerstrasse 12c • 6300 Zug

T +41 41 720 47 90 • F +41 41 720 47 91 • info@vv-ag.ch